In 2022 InfoTrack launched The Onboarding Summit to explore the opportunities and challenges of delivering brilliant digital client onboarding. Here we take one of the most widely discusses topics, digital ID verification, and explore how it works and why it is a valuable solution in the law firm toolkit to mitigate risk and meet due diligence requirements to enhance compliance.

How does digital ID verification enhance security and compliance for law firms?

With the demand for digital onboarding for law firms increasing, we invited the experts on all things digital ID, GBG, to chat with us about the technology behind their digital ID verification solutions. If you missed their session with TrueLayer at The Onboarding Summit, you can catch up on-demand now.

Fraud is a major area of risk for law firms, which is why it’s imperative they have top-notch solutions in place to help mitigate the risk of imposters. One of the most secure ways to manage this risk is by using digital ID verification services to ensure your clients are really who they say they are.

A 2021 study by LPM (Legal Practice Management) predicted that client-facing portals will be the technology that will have the most impact on law firm competitiveness in the next 5 years. Understanding how these add value to your onboarding process will not only support your due diligence requirements but also enhance you’re the client experience.

A major component of effective digital onboarding is a secure and reliable digital ID verification tool. In this article, we’ll review what digital ID verification covers, how it works including the various types of technology that power the checks, and how eCOS from InfoTrack can help your firm streamline the digital onboarding process.

What is digital identity verification?

Digital identity verification is a process that checks and confirms a person is who they say they are. The reason ID verification is required, especially in law, is to prevent fraud being committed by imposters. What differentiates digital ID checks from more traditional methods is the technology used to verify a person's identity. Digital ID checks use a broader range of reference points to validate a person’s identity, including contextual data such as phone numbers, IP addresses or biometric data in addition to the government issued ID document.

How do digital ID checks work?

You might be wondering how digital ID checks work. Depending on the technology you use, there are several processes that can be undertaken to verify a person’s identity digitally. Here we breakdown some of the most common and trusted technologies used when completing digital ID checks.

ID verification

This solution verifies the authenticity of a client’s government-issued ID in seconds. Leveraging artificial intelligence (AI), machine learning, optical character recognition (OCR), and computer vision to determine if an ID document is genuine by inspecting the presence of security features against known document templates. A variety of security features are inspected within the ID including the font, picture, barcode/MRZ, watermarks, holograms, ghost images, and microprint.

3D liveness detection

Liveness detection requests the user to carry out between one to seven steps to prove it’s them and not an avatar: smile, frown, tilt head left, tilt head right, tilt head back, tilt head forward and look straight ahead. The sequence is randomised so that fraudsters can’t prepare. The resulting facial images that are captured are then compared to the user’s photo ID to ensure that they are the owner of the ID document.

Biometric FaceMatch

Using biometric data stored on a chip within certain documents, called NFC, GBG’s FaceMatch technology provides instant validation of facial recognition features between a printed document face (e.g. a passport photo) and a live face image captured by a smartphone, tablet or webcam. After taking a photo of an identity document, a user can further authenticate themselves by placing their face in the viewfinder of the forward-facing camera on their device. Identifying against a set of 68 facial landmarks for each image, FaceMatch uses these to extract the facial recognition features and compare against the document to produce a reliable judgement of whether a genuine presence is being presented.

Reading and extracting biometric chip information

Using Near Field Communication (NFC) on supported devices, such as Android phones and tablets; details and images can be read from biometric chips and compared against the details on the document to help prevent fraud and improve extraction. The technology recognises and extracts relevant data points from your customer’s ID document including name, document number etc, using OCR. This utilises the details in the document library, recognising the format of the document, where the data fields are located, and how it’s formatted to verify the ID digitally.

How digital ID verification improves law firm compliance and due diligence requirements

Fraudsters are becoming increasingly more sophisticated, which means the solutions you use need to stay in pace to mitigate the risk of fraud. With more transactions taking place online, digital ID verification continues to be a more secure method of verifying someone’s identity. By using a variety of solutions that check multiple reference points on government issued ID documents, you can have peace of mind that your clients are really who they claim to be.

We’ve outlined the different types of technology that are most commonly involved in digital ID checks, all of which can better weed out imposters than manual ID checks. Using multiple data points, including biometric information to authenticate a person’s identity, your firm can trust that digital ID are reliable and secure – ensuring you appropriately meet your compliance requirements.

Why is digital ID verification more reliable? Because the data doesn’t lie. While manual checks are open to the risk of human error, especially with fraudsters using high-end technology to try to scam their way through, the various checks of digital ID verification cannot be fooled by avatars, or fraudulent documents.

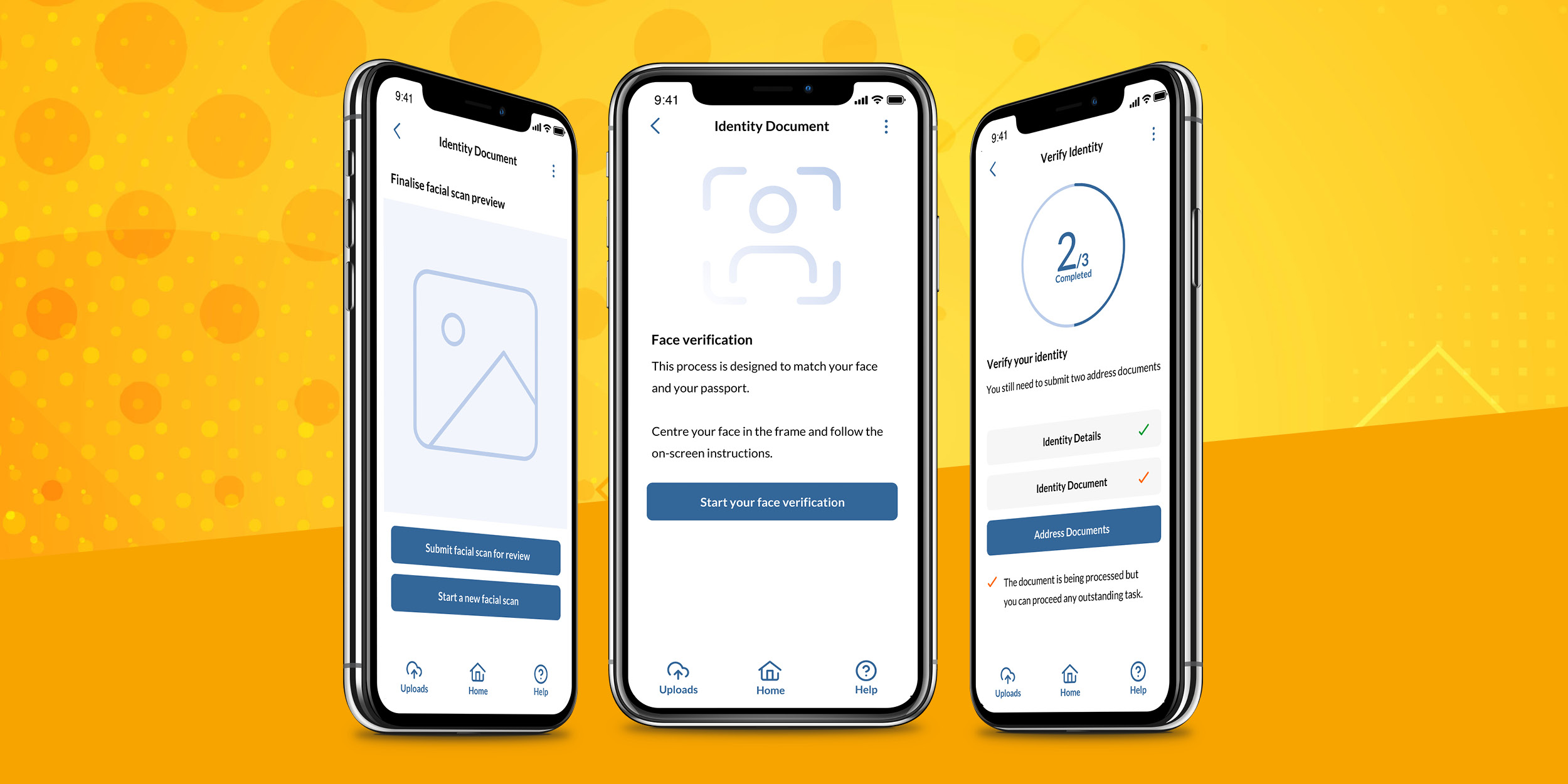

Digital ID verification with eCOS

Are you looking to improve your due diligence process by employing a digital ID verification process? eCOS from InfoTrack gives you access to a complete digital onboarding service, with in-built digital Verification of Identity, Source of Funds checks, e-signatures, and onboarding questionnaires, as well as additional conveyancing-specific forms for conveyancing matters including licensed Law Society TA forms.

Using a consumer-friendly platform, law firms can access a fully branded web solution and mobile app that reduces client onboarding from two weeks to two days. We integrate with GBG to provide access to industry-leading digital ID verification technology that helps your firm mitigate risk and adhere to your customer due diligence requirements.

Our client, Hannah Solicitors, has onboarded over 1,000 clients digitally with eCOS, saving them hundreds of hours. Since implementing eCOS, they’ve improved the client experience by maximising speed, security, and efficiency. Download the case study now to find out how eCOS could help your firms onboard better digitally too.

Discover more about Digital ID verification with GBG

We recently caught up with Ophelie Aymonier, Senior Account Manager at GBG, to find out more about the technology behind Digital ID verification and how it really works. Watch the session now from The Onboarding Summit now.