Authenticate your client’s identity with confidence through our powerful suite of bank-grade electronic ID verification tools.

Client verification the faster, more secure way

Client identity verification checks are an essential part of the due diligence process for law firms. Yet, validating IDs and documents can be time consuming and leaves you exposed to risks. It’s why we’ve developed our Verification of Identity (VOI) solution, giving you access to a powerful suite of technology that delivers bank-grade electronic ID checks quickly, easily, and more reliably.

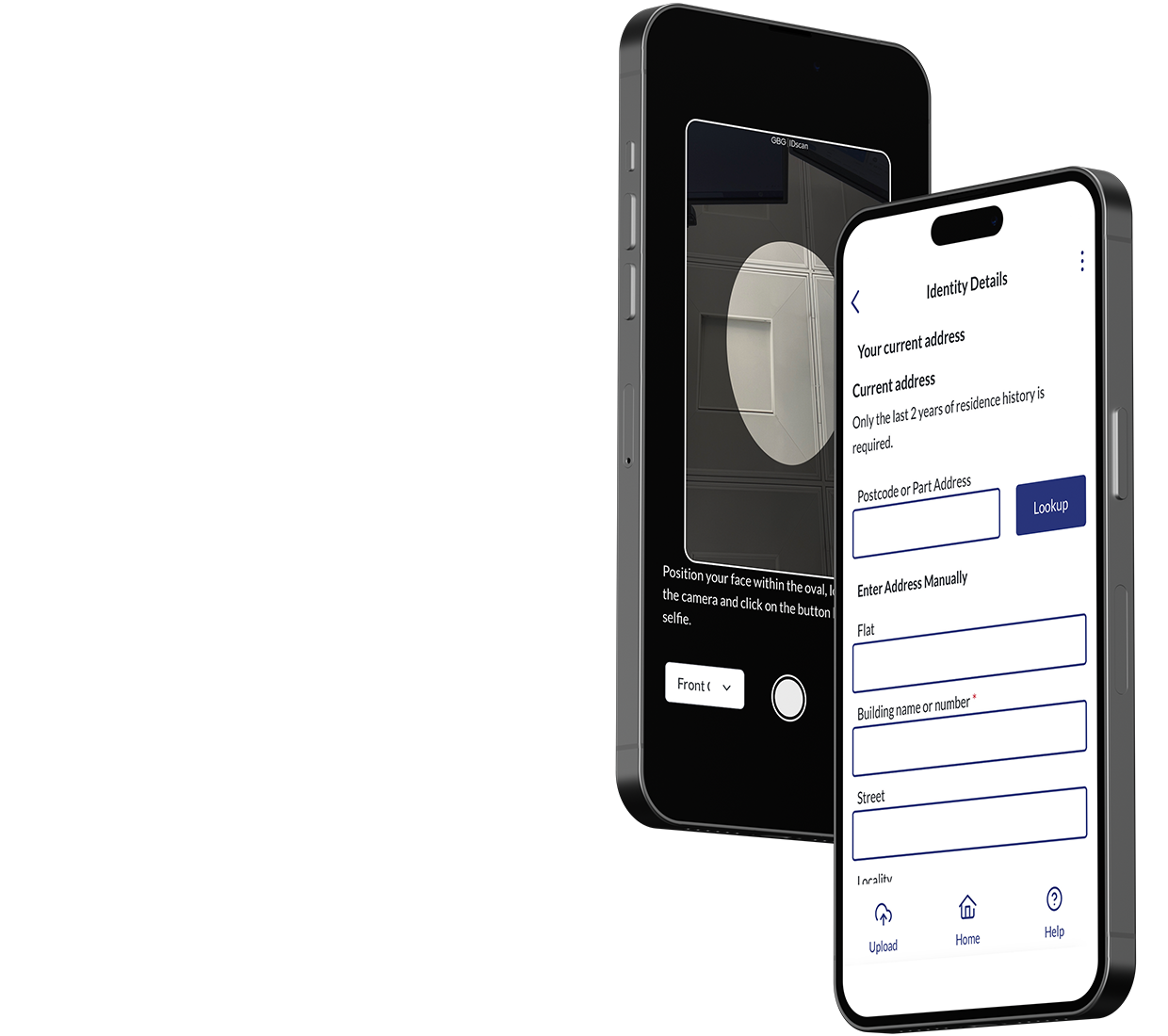

Built into our eCOS™ onboarding workspace, everything you need to verify the identity of your clients and their documents is accessible within a single platform, powered by the latest global biometric identification technology.